The Effect Of Sales Growth, Profitability And Firm Age Toward Tax Avoidance On Consumer Goods Companies Listed On The Indonesia Stock Exchange

DOI:

https://doi.org/10.8888/ijospl.v4i1.117Keywords:

sales growth, profitability, firm age, tax avoidanceAbstract

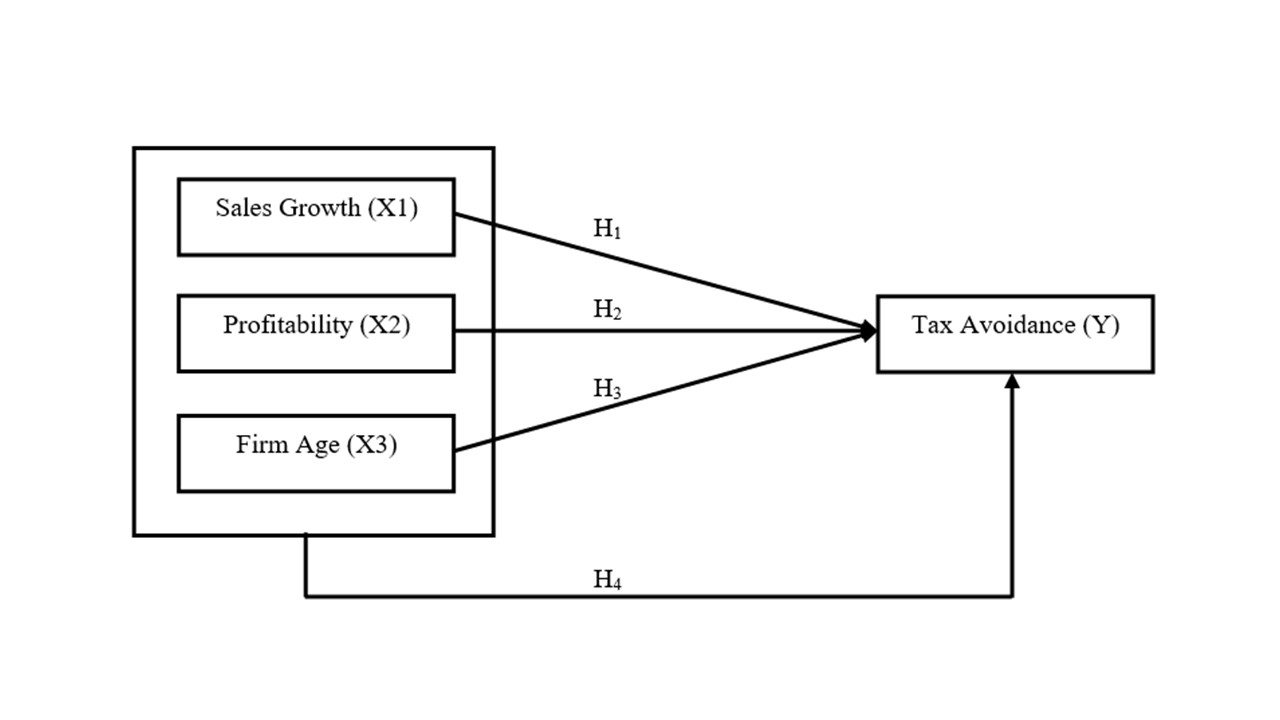

This research objective is to find out whether leverage, liquidity and profitability have significant effect toward This study aims to investigate the effect of Sales Growth, Profitability (ROA), and Firm Age towards Tax Avoidance (CETR). The population on this study is consumer goods companies listed at the Indonesia Stock Exchange for period of 2018-2020 which in total 73 companies. The sample for this study was collected using a purposive sampling, which resulted into 32 companies that fulfilled the criteria of this study. Therefore, the total research data collected from 2018 to 2020 is 96 samples. For the data analysis method, this study used several statistical tests, include descriptive statistics analysis, classical assumption test, double linear regression analysis, and hypothesis test. The result of this study shows that Sales Growth partially have significant effect toward Tax Avoidance (CETR). Profitability (ROA) partially does not have significant effect toward Tax Avoidance (CETR). Firm Age partially does not have significant effect toward Tax Avoidance (CETR). However, Sales Growth, Profitability (ROA), and Firm Age simultaneously have significant effect toward Tax Avoidance (CETR).

Keywords: sales growth, profitability, firm age, tax avoidance

Downloads

References

Antari, N. W., & Setiawan, P. E. (2020). Pengaruh Profitabilitas, Leverage dan Komite Audit pada Tax Avoidance. E-Jurnal Akutansi, 30(10). Retrieved from https://ojs.unud.ac.id/index.php/akuntansi/article/view/57656

Aprilia. (2020). Pengaruh Intensitas Aset Tetap, Karakter Eksekutif, Koneksi Politik dan Leverage Terhadap Tax Avoidance (Studi pada Perusahaan Makanan dan Minuman yang Terdaftar di Brusa Efek Indonesia Tahun 2014-2018). Jurnal Ilmiah Akuntansi dan Finansial Indonesia, 3(2), 18-19. doi:https://doi.org/10.31629/jiafi.v3i2.2205

Arifin, J. (2017). SPSS 24 untuk Penelitian dan Skripsi. PT Elex Media Komputindo. Retrieved from https://books.google.co.id/books?id=hDBIDwAAQBAJ&printsec=frontcover&dq=pengertian+test+normality+spss&hl=jv&sa=X&redir_esc=y#v=onepage&q=pengertian%20test%20normality%20spss&f=false

Asri, A. (2021). Buku Ajar Hukum Pajak & Peradilan Pajak. CV Jejak. Retrieved from https://books.google.co.id/books?id=OjsoEAAAQBAJ&printsec=frontcover&dq=hukum+perpajakan&hl=jv&sa=X&redir_esc=y#v=onepage&q=hukum%20perpajakan&f=false

Bandaro, L. A., & Ariyanto, S. (2020). Pengaruh Profitabilitas, Ukuran Perusahaan, Leverage, Kepemilikan Manajerial dan Capital Intensity Ratio Terhadap Tax Avoidance. Ultima Accounting: Jurnal Ilmu Akutansi, 12(2). doi:https://doi.org/10.31937/akuntansi.v12i2.1883

Damanik, E. O., & Sriwiyanti, E. (2020). Perpajakan. ICM. Retrieved from https://books.google.co.id/books?id=EzogEAAAQBAJ&printsec=frontcover&dq=pengertian+perpajakan&hl=jv&sa=X&redir_esc=y#v=onepage&q=pengertian%20perpajakan&f=false

Dewinta, I. A., & Setiawan, P. E. (2016). Pengaruh Ukuran Perusahaan, Umur Perusahaan, Profitabilitas, Leverage, dan Pertumbuhan Penjualan Terhadap Tax Avoidance. E-Jurnal Akutansi Universitas Udayana, 14(3). Retrieved from https://ojs.unud.ac.id/index.php/akuntansi/article/view/16009

Duli, N. (2019). Metodologi Penelitian Kuantitatif: Beberapa Konsep Dasar Untuk Penulisan Skripsi & Analisis Data dengan SPSS. Deepublish. Retrieved from https://books.google.co.id/books?id=A6fRDwAAQBAJ&pg=PA114&dq=pengertian+Uji+Multikolinearitas&hl=jv&sa=X&ved=2ahUKEwjmy5Wqheb2AhU58XMBHR-vChQQ6AF6BAgJEAI#v=onepage&q=pengertian%20Uji%20Multikolinearitas&f=false

Endiana, I. D. (2016). Analisis Faktor-Faktor yang Berpengaruh Terhadap Keputusan Investasi dengan Growth Opportunity sebagai Moderating Variabel. Jurnal Ilmiah Manajemen & Akuntansi, 22(1). Retrieved from http://triatmamulya.ejurnal.info/index.php/triatmamulya/article/view/73

Firdaus. (2021). Metode Penelitian Kuantitatif Dilengkapi Analisis Regresi IBM SPSS Statistics Version 26.0. Dotplus. Retrieved from https://books.google.co.id/books?id=lJ8hEAAAQBAJ&printsec=frontcover&dq=uji+autokorelasi&hl=jv&sa=X&redir_esc=y#v=onepage&q=uji%20autokorelasi&f=false

Firmansyah, A., & Triastie, G. A. (2021). Bagaimana Peran Tata Kelola Perusahaan dalam Penghindaran Pajak, Pengungkapan Tanggung Jawab Sosial Perusahaan, Pengungkapan Risiko, Efisiensi Investasi. Indramayu: CV. Adanu Abimata. Retrieved from https://www.google.co.id/books/edition/Bagaimana_Peran_Tata_Kelola_Perusahaan_D/mVYsEAAAQBAJ?hl=id&gbpv=1&dq=penghindaran+pajak&pg=PA21&printsec=frontcover

Gunawan, C. (2020). Mahir Menguasai SPSS Panduan Praktis Mengolah Data Penelitian. CV Budi Utama. Retrieved from https://books.google.co.id/books?id=babXDwAAQBAJ&printsec=frontcover&dq=pengertian+Uji+Multikolinearitas&hl=jv&sa=X&redir_esc=y#v=onepage&q&f=false

Hardisman. (2020). Mudah, Praktis, Gratis, dan Legal Analisis Data dan Statistik Kesehatan dengan Program JASP. Guepedia. Retrieved from https://books.google.co.id/books?id=heL8DwAAQBAJ&pg=PA85&dq=pengertian+uji+normalitas&hl=jv&sa=X&ved=2ahUKEwiqz9Ds--X2AhVGRmwGHVuZA_MQ6AF6BAgEEAI#v=onepage&q=pengertian%20uji%20normalitas&f=false

Honggo, K., & Marlinah, A. (2019). Pengaruh Ukuran Perusahaan, Umur Perusahaan, Dewan Komisiaris Independen, Komite Audit, Sales Growth dan Leverage Terhadap Penghindaran Pajak. Jurnal Bisnis dan Akuntansi, 21(1a-1). Retrieved from http://jurnaltsm.id/index.php/JBA/article/view/705

HS, S., & Anlia, V. L. (2021). Kinerja Keuangan Perusahaan Jakarta Islamic Index di Masa Pandemi Covid-19. Insania. Retrieved from https://books.google.co.id/books?id=9mRYEAAAQBAJ&pg=PA108&dq=pengertian+profitability+pada+perusahaan&hl=jv&sa=X&ved=2ahUKEwiY9ofHkdz2AhV8kNgFHZ60AccQ6AF6BAgHEAI#v=onepage&q=pengertian%20profitability%20pada%20perusahaan&f=false

I Dewa Made Endiana. (2016). ANALISIS FAKTOR-FAKTOR YANG BERPENGARUH TERHADAP KEPUTUSAN INVESTASI DENGAN GROWTH OPPORTUNITY SEBAGAI MODERATING VARIABEL. Jurnal Manajemen & Akuntansi, 22(1), 88–100.

Jekang, P., & Hama, A. (2022). the Effect of Inventory Intensity, and Liquidity on Tax Aggressiveness on Food and Beverage Companies Listed on the Indonesia Stock Exchange. Journal of Mantik, 6(1), 891–898.

Murwaningtyas, N. E. (2019). FAKTOR-FAKTOR YANG MEMENGARUHI PENGHINDARAN PAJAK. Jurnal Akuntansi, Audit Dan Sistem Informasi Akuntansi, 1, 1–476.

Pohan, C. A. (2013). Manajemen Perpajakan Strategi Perencanaan Pajak dan Bisnis. Jakarta?:Gramedia Pustaka Utama.

Sugiyono. (2018). Metode Penelitian Kuantitatif, Kualitatif, dan R&D. Bandung?: Alfabeta

Suryani, & Mariani, D. (2019). Pengaruh Umur Perusahaan, Ukuran Perusahaan Dan Profitabilitas Terhadap Penghindaran Pajak Dengan Leverage Sebagai Variabel Pemoderasi. Jurnal Ilmiah MEA (Manajemen, Ekonomi, & Akuntansi), 3(3), 259–283.

Wahyuni, T., & Wahyudi, D. (2021). Pengaruh Profitabilitas, Leverage, Ukuran Perusahaan, Sales Growth, dan Kualitas Audit Terhadap Tax Avoidance. Kompak: Jurnal Ilmiah Komputerisasi Akuntansi, 14(2), 394–403. http://journal.stekom.ac.id/index.php/kompak?page394

Wardani, D. K., & Isbela, P. D. (2018). Pengaruh Strategi Bisnis Dan Karakteristik Perusahaan Terhadap Manajemen Laba. Jurnal Riset Akuntansi Dan Keuangan, 13(2), 91. https://doi.org/10.21460/jrak.2017.132.283

Yustrianthe, R. H., & Mahmudah, S. (2021). Return on Equity, Debt To Total Asset Ratio, and Company Value. Riset, 3(2), 534–549. https://doi.org/10.37641/riset.v3i2.88

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 INTERNATIONAL JOURNAL OF SOCIAL, POLICY AND LAW

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.